- Home |

- International |

- Countries We Export To

Your Export Partner

- Seamlessly connecting South Africa to the World

Our Shipping Routes

Make informed purchase decision by visiting our in-country guide

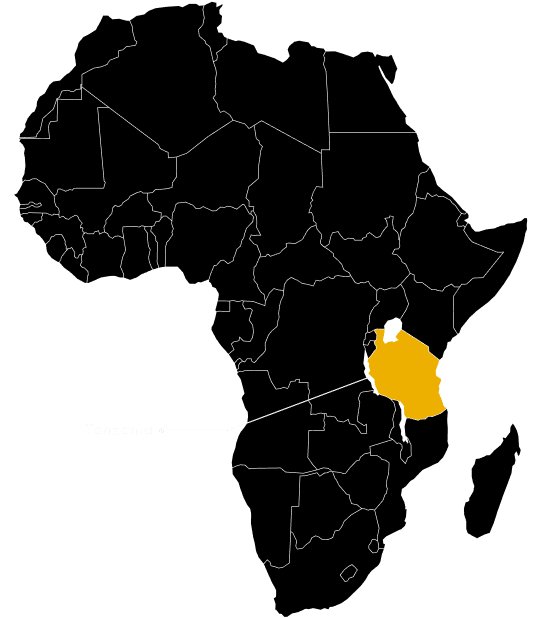

Exporting a Vehicle to Tanzania

The country's economic capital, Dar es Salaam, is located 3,800 kilometres by road from Johannesburg. Sea freight takes 6-7 days from Durban port to Dar es Salaam port.

If a car is transported by road, the driver or truck should exit South Africa and enter Botswana via the Kopfontein or Martin's Drift border. The driver will then proceed to cross Botswana and enter Zambia via the Kazungula border post. Finally, the driver will travel through Zambia and enter Tanzania via the Tunduma border post.

Important Details for Importing a Vehicle into Tanzania

Tanzania Import Guidelines for Used Vehicles

Ports of Entry

Via Land/Road Transport: Tunduma border post (Zambia/Tanzania) or Kasumulu border post (Malawi/Tanzania)

Via Ocean Freight: Port of Dar es Salaam

Via Air Freight: Dar es Salaam International Airport or Kilimanjaro International Airport

Age of Restrictions

There is no age restriction on vehicle imports into Tanzania. However, cars older than 7 years are penalized with excise duty to reduce dumping.

Required Documents

-

Bill of Lading or Manifest

Ensure you possess the original Bill of Lading for customs clearance. - Commercial/Purchase Invoice from the Supplier

- Passport, Identification Document, or Certificate of Incorporation for Companies

-

Certificate of Title and Registration (Natis - RC1)

Provide the original certificate of title and registration for the imported vehicle. -

SARPCCO Certificate and RPC

SARPCCO stands for Southern African Regional Police Chiefs Cooperation Organisation. The certificate certifies that the vehicle was not reported as stolen within one of the Southern African countries. - Interpol Clearance

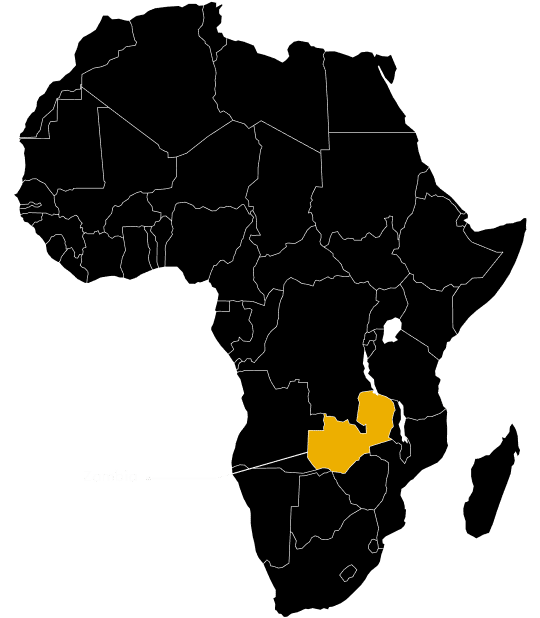

Exporting a Vehicle to Zambia

The country's capital, Lusaka, is located 2,000 kilometres by road from Johannesburg. Vehicles exported to Zambia should exit South Africa and enter Botswana via the Kopfontein or Martin's Drift border. The driver will then proceed to cross Botswana and enter Zambia via the Kazungula border post.

Important Details for Importing a Vehicle into Zambia

Zambia Import Guidelines for Used Vehicles

Ports of Entry

Via Land/Road Transport: Kazungula border post (Botswana/Zambia) or Chirundu border post (Zimbabwe/Zambia)

Via Air Freight: Kenneth Kaunda International Airport

Age of Restrictions

There is no age restriction on vehicle imports into Zambia.

Required Documents

-

Bill of Lading or Manifest

Ensure you possess the original Bill of Lading for customs clearance. - Commercial/Purchase Invoice from the Supplier

- Passport, Identification Document, or Certificate of Incorporation for Companies

-

Certificate of Title and Registration (Natis - RC1)

Provide the original certificate of title and registration for the imported vehicle. -

SARPCCO Certificate and RPC

SARPCCO stands for Southern African Regional Police Chiefs Cooperation Organisation. The certificate certifies that the vehicle was not reported as stolen within one of the Southern African countries.

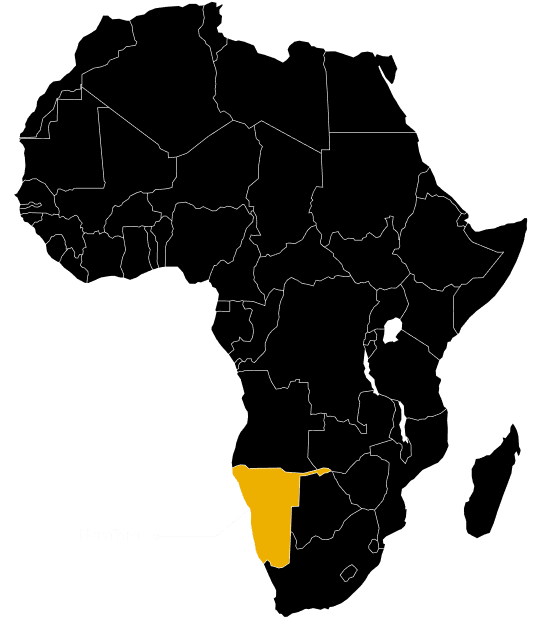

Exporting a Vehicle to Namibia

The country's capital, Windhoek, is located 1,400 kilometres by road from Johannesburg. Namibia is part of the SACU union and is South Africa's biggest destination for vehicle exports, with exports valued at $450 million in 2023.

Important Details for Importing a Vehicle into Namibia

Namibia Import Guidelines for Used Vehicles

Ports of Entry

Via Land/Road Transport: Noordoewer/Vioolsdrif border post for traffic from the Western Cape and southern provinces of South Africa or Ariamsvlei/Nakop border post for traffic from Gauteng and Eastern provinces of South Africa

Via Ocean Freight: Walvis Bay Port

Age of Restrictions

The import age restriction for vehicle imports into Namibia is 12 years.

Required Documents

- Valid Import Permit

-

Bill of Lading or Manifest

Ensure you possess the original Bill of Lading for customs clearance. - Commercial/Purchase Invoice from the Supplier

- Passport, Identification Document, or Certificate of Incorporation for Companies

-

Certificate of Title and Registration (Natis - RC1)

Provide the original certificate of title and registration for the imported vehicle. -

SARPCCO Certificate and RPC

SARPCCO stands for Southern African Regional Police Chiefs Cooperation Organisation. The certificate certifies that the vehicle was not reported as stolen within one of the Southern African countries.

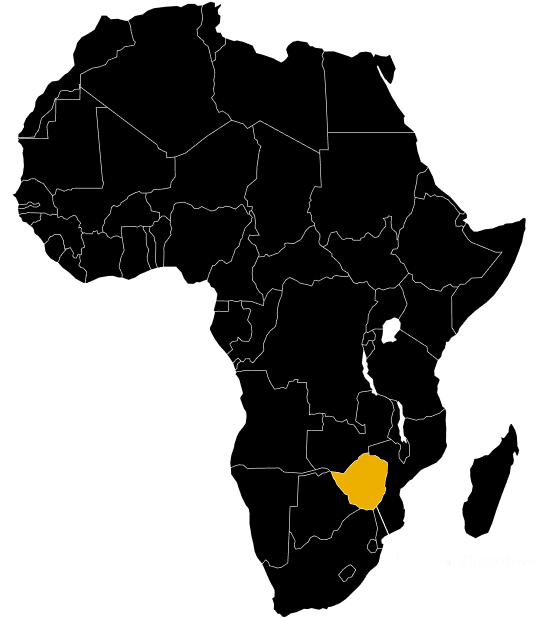

Exporting a Vehicle to Zimbabwe

The country's capital, Harare, is located 1,200 kilometres by road from Johannesburg. Zimbabwe is South Africa's second-biggest vehicle importer in Africa, with imports valued at $330 million in 2023

Important Details for Importing a Vehicle into Zimbabwe

Zimbabwe Import Guidelines for Used Vehicles

Ports of Entry

Via Land/Road Transport:

Beitbridge border post for traffic from Gauteng

Ramokgwebane in Botswana for traffic deviated through Francistown

Age of Restrictions

The year of manufacture should not exceed 10 years. Cars older than 10 years are penalized via higher excise duty.

Required Documents

- Export Bill of Entry and Supporting Documents

- Commercial/Purchase Invoice from the Supplier

- Passport, Identification Document, or Certificate of Incorporation for Companies

-

Certificate of Title and Registration (Natis - RC1)

Provide the original certificate of title and registration for the imported vehicle. -

SARPCCO Certificate and RPC

SARPCCO stands for Southern African Regional Police Chiefs Cooperation Organisation. The certificate certifies that the vehicle was not reported as stolen within one of the Southern African countries. - Police Clearance

- Import Permit

- Bill of Lading or Manifest

- Ensure you possess the original Bill of Lading for customs clearance.

Exemptions

Certain special groups are exempt from paying taxes on imported goods. These include returning residents, handicapped persons, diplomats, and temporary import permits holders. See attached links for more details.

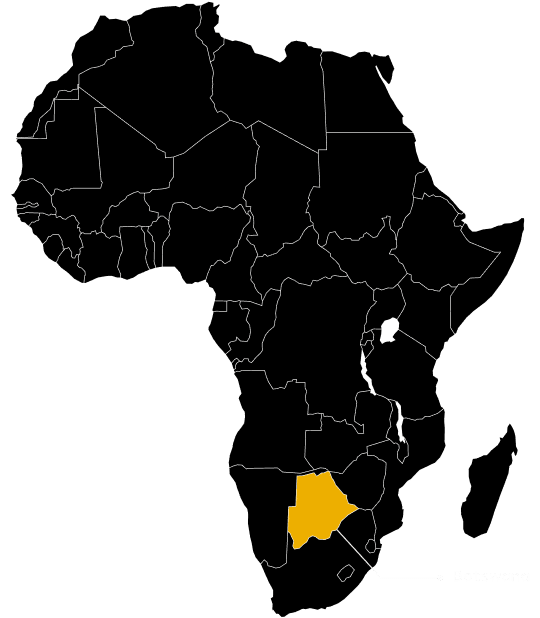

Exporting a Vehicle to Botswana

Important Details for Importing a Vehicle into Botswana

Botswana Import Guidelines for Used Vehicles

Ports of Entry

Via Land/Road Transport:

Vehicle will enter Botswana via Kopfontein border post

Age of Restrictions

There is no age restriction on the importation of used cars into Botswana.

Required Documents

- Customs Declaration Forms - SAD 500

- Commercial/Purchase Invoice from the Supplier

- Passport, Identification Document, or Certificate of Incorporation for Companies

-

Certificate of Title and Registration (Natis - RC1)

Provide the original certificate of title and registration for the imported vehicle. - SARPCCO Certificate and RPC

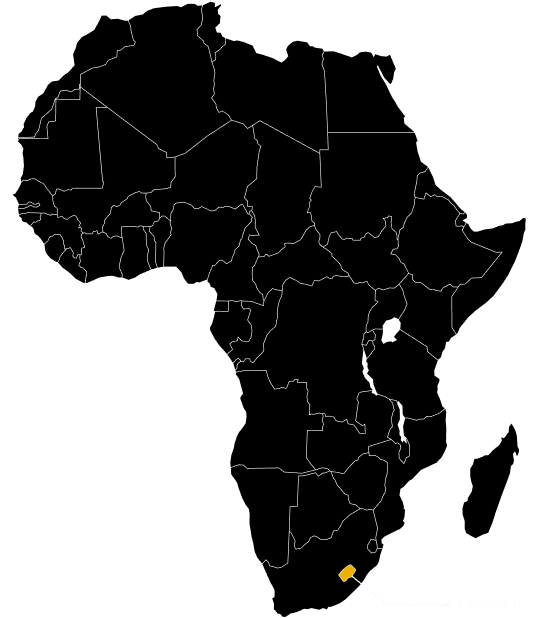

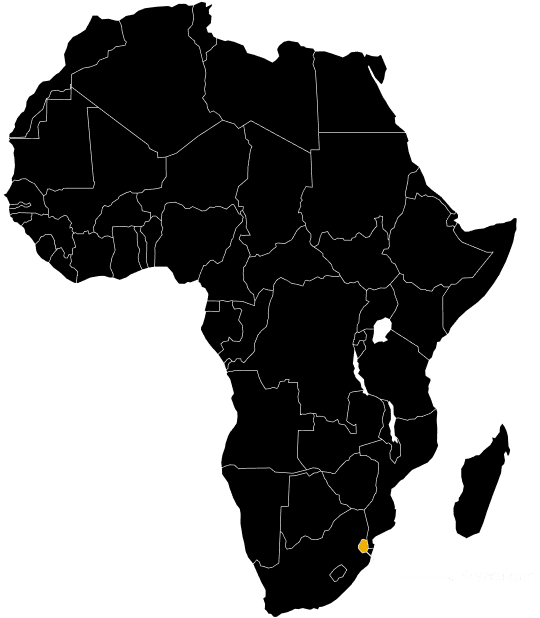

Exporting a Vehicle to Lesotho

The country’s capital, Maseru, is located 400 kilometres from Johannesburg by road. Lesotho is a member of SACU, allowing its citizens to enjoy lower import duty rates. Lesotho is South Africa’s tenth-biggest vehicle importer in Africa, with imports valued at $80 million in 2023.

Important Details for Importing a Vehicle into Lesotho

Tanzania Import Guidelines for Used Vehicles

Ports of Entry

Via Land/Road Transport:

Vehicle will enter Lesotho via Maseru border post or any other border posts between South Africa

and Lesotho.

Age of Restrictions

There is no age restriction on the importation of used cars into Lesotho.

Required Documents

-

Manifest

Ensure you possess the original Bill of Lading. - Commercial/Tax Invoice

- Identification Documents

- Certificate of Title and Registration (Natis - RC1)

- Provide the original certificate of title and registration for the imported vehicle.

- De-registration Certificate (ARN)

- SARPCCO Certificate and RPC

- Police Clearance

- Import Permit

Exporting a Vehicle to Malawi

The country's capital, Lilongwe, is located 2,200 kilometers from Johannesburg by road. Vehicles will exit South Africa via Zimbabwe's Beitbridge border and travel through Zimbabwe, a small portion of Mozambique before entering Malawi via the Mwanza border post. Alternatively, vehicles may exit South Africa via Botswana's Martin's Drift border post, travel through Botswana and Zambia, and enter Malawi via Mwami border post.

Important Details for Importing a Vehicle into Malawi

Malawi Import Guidelines for Used Vehicles

Ports of Entry

Via Land/Road Transport: Dedza border post if the car is entering Malawi from Mozambique.

Mwami border post if the vehicle is entering Malawi from Zambia.

Age of Restrictions

There is no age restriction on the importation of used cars into Malawi.

Exemptions

Certain special groups are exempt from paying taxes on imported goods. These include returning residents, diplomats, and temporary import permit holders.

Required Documents

-

Bill of Lading or Manifest

Ensure you possess the original Bill of Lading. - Commercial/Purchase Invoice

- Identification Documents

-

Certificate of Title and Registration (Natis - RC1)

Provide the original certificate of title and registration for the imported vehicle. -

Import Permit from the Department of Trade and Industry

Obtain an import permit from the Department of Trade and Industry to facilitate a smooth import process. - SARPCCO Certificate and RPC

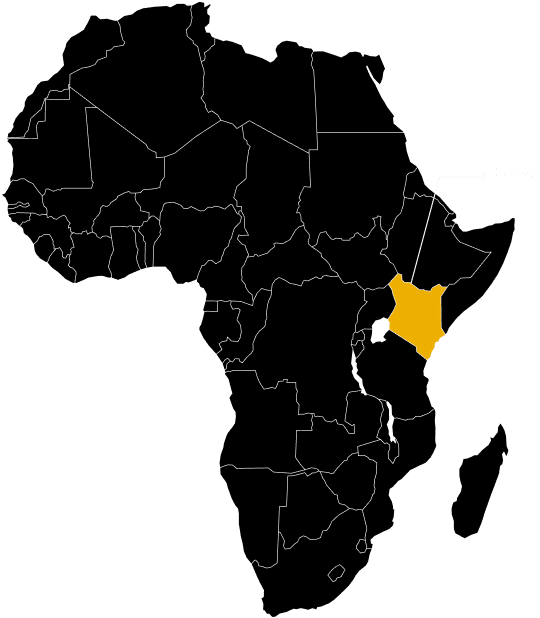

Exporting a Vehicle to Kenya

The country's capital, Nairobi, is located 4,200 kilometres from Johannesburg by road. Cars destined for Kenya may be delivered either by ocean freight from Durban to Mombasa port or via road freight. If using road freight, the truck will drive through Botswana, Zambia, and Tanzania, entering Kenya via the Namanga border post, which Kenya shares with Tanzania. Kenya is South Africa's 9th largest vehicle export destination, with exports worth $82 million in 2023.

Important Details for Importing a Vehicle into Kenya

Kenya Import Guidelines for Used Vehicles

Ports of Entry

Via Land/Road Transport: Namanga border post for vehicles entering Kenya via Tanzania.

Ocean Freight: Mombasa port

Air Freight: Jomo Kenyatta International Airport

Age of Restrictions

The vehicle must be less than 8 years from the first date of registration. Vehicles older than 8 years will incur higher excise duty penalties.

Exemptions

Certain special groups are exempt from paying taxes on imported goods. These include returning residents, diplomats, and temporary import permit holders.

Required Documents

-

Pre-shipment Inspection Certificate

Obtained from South Africa, this certificate ensures the roadworthiness of the vehicle. -

Bill of Lading and Commercial/Purchase Invoice

Ensure you possess the original Bill of Lading and the commercial/purchase invoice for customs clearance. - Driver's License, Identification Document, or Certificate of Incorporation for Companies

-

Certificate of Title and Registration (Natis - RC1)

Provide the original certificate of title and registration for the imported vehicle. - SARPCCO Certificate and Police Clearance

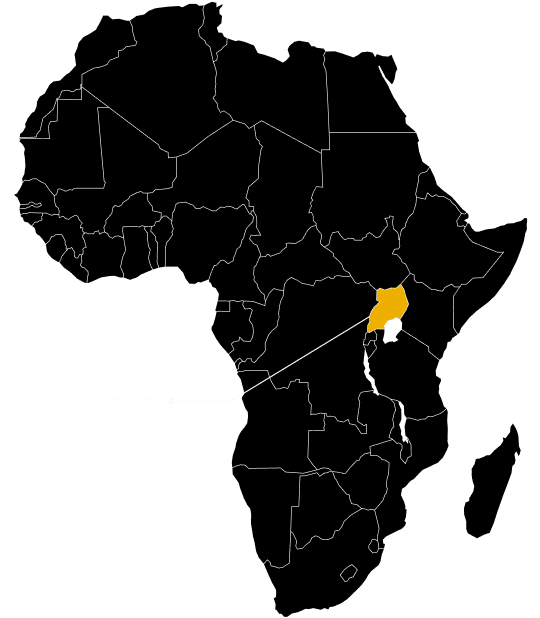

Exporting a Vehicle to Uganda

The country’s capital, Kampala, is located 4,400 kilometres from Johannesburg by road. Cars destined for Uganda may be delivered either by ocean freight from Durban to Mombasa port and then transported to Uganda from Kenya. If using road freight, the truck will drive through Botswana, Zambia, and Tanzania, entering Uganda via the Mutukula border post, which Uganda shares with Tanzania. Cars arriving in Uganda via either Kenya or Tanzania must be registered by the respective revenue/customs authorities in the said countries.

Important Details for Importing a Vehicle into Uganda

Click on the link above to compute motor vehicle import tax.

Ports of Entry

Via Land/Road Transport: Mutukula one-stop border post for vehicles entering Uganda via Tanzania.

Malaba border post for vehicles entering Uganda via Kenya.

Air Freight: Entebbe International Airport

Age of Restrictions

The vehicle must be less than 15 years from the first date of registration. Vehicles older than 15 years will incur higher excise duty penalties.

Exemptions

Certain special groups are exempt from paying taxes on imported goods. These include returning residents, diplomats, and temporary import permit holders.

Required Documents

- DA 304S Form

- Bill of Lading/Manifest

- Ensure you possess the original Bill of Lading.

- Commercial Invoice

- Passport, Identification Document, or Certificate of Incorporation for Companies

-

Certificate of Title and Registration (Natis - RC1)

Provide the original certificate of title and registration for the imported vehicle. - SARPCCO Certificate and Police Clearance

- Interpol Clearance

- SAD 500 Bill of Entry

Exporting a Vehicle to Swaziland

The country's capital, Mbabane, is located 400 kilometres from Johannesburg by road. Swaziland is South Africa's 7th largest destination for vehicle exports. In 2023, vehicle exports from South Africa to Swaziland were valued at $106 million.

Important Details for Importing a Vehicle into Eswatini

Swaziland Import Guidelines for Used Vehicles

Ports of Entry

Via Land/Road Transport: Vehicles can enter Eswatini through several border posts it shares with South Africa. The Golela border post is often the busiest.

Age of Restrictions

The vehicle must be less than 15 years from the first date of registration. Vehicles older than 15 years will incur higher excise duty penalties.

Exemptions

Certain special groups are exempt from paying taxes on imported goods. These include returning residents, diplomats, and temporary import permit holders.

Required Documents

- DA 304S Form

- Bill of Lading/Manifest

- Ensure you possess the original Bill of Lading.

- Commercial Invoice

- Passport, Identification Document, or Certificate of Incorporation for Companies

-

Certificate of Title and Registration (Natis - RC1)

Provide the original certificate of title and registration for the imported vehicle. - SARPCCO Certificate and Police Clearance

- Interpol Clearance

- SAD 500 Bill of Entry

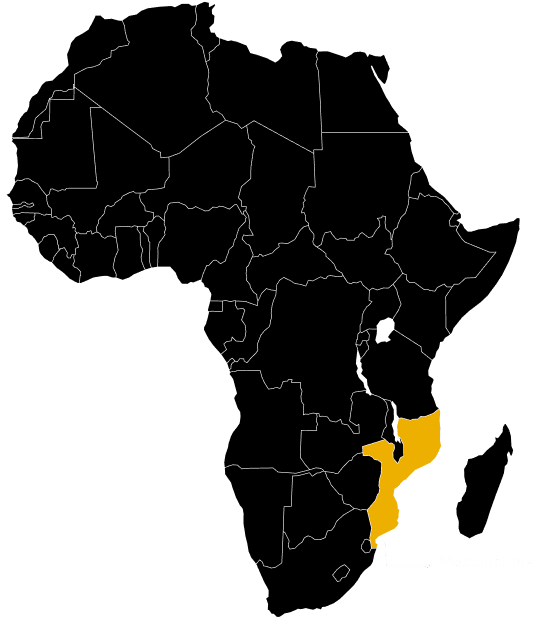

Exporting a Vehicle to Mozambique

The country's capital, Maputo, is located 550 kilometres from Johannesburg by road. Mozambique is South Africa's 5th largest destination for vehicle exports. In 2023, vehicle exports from South Africa to Mozambique were valued at $160 million.

Important Details for Importing a Vehicle into Mozambique

Mozambique Import Guidelines for Used Vehicles

Ports of Entry

Via Land/Road Transport: Vehicles can enter Mozambique

through several border posts it shares with South Africa.

The Komatipoort border post is one of the most frequently

used posts.

Age of Restrictions

There is no age restriction for vehicle imports into Mozambique.

Exemptions

Certain special groups are exempt from paying taxes on imported goods. These include returning residents, diplomats, and temporary import permit holders.

Required Documents

-

Bill of Lading/Manifest

Ensure you possess the original Bill of Lading. - Commercial Invoice

- Passport, Identification Document, or Certificate of Incorporation for Companies

-

Certificate of Title and Registration (Natis - RC1)

Provide the original certificate of title and registration for the imported vehicle. - SARPCCO Certificate and Police Clearance

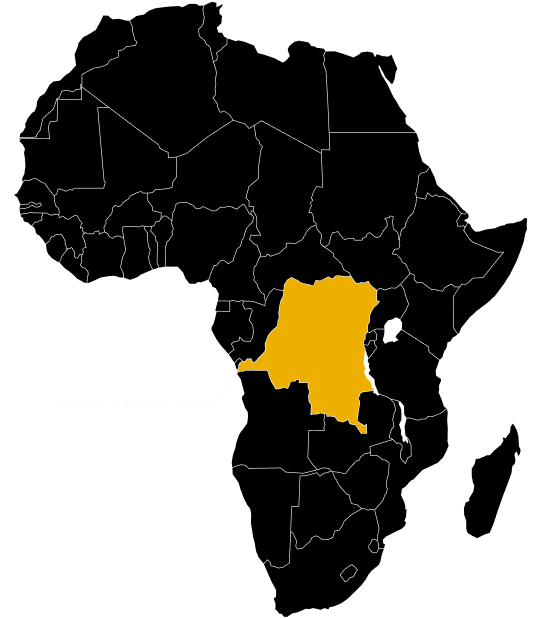

Exporting a Vehicle to Democratic Republic of Congo (DRC)

The country's capital, Kinshasa, is located 4,400 kilometres from Johannesburg by road. The DRC is South Africa's 6th largest destination for vehicle exports. In 2023, vehicle exports from South Africa to the DRC were valued at $126 million.

Important Details for Importing a Vehicle into Democratic Republic of Congo (DRC)

Clients should consult their local clearing agents for up-to-date information on import procedures and duty payments.

Democratic Republic of Congo (DRC) Import Guidelines for Used Vehicles

Ports of Entry

Via Land/Road Transport: Vehicles can enter the DRC through

several border posts it shares with Zambia.

The Kasumbalesa and Sakania border posts are frequently

used.

Age of Restrictions

Imported second-hand cars or buses (below 10 seats) must be less than 10 years old.

Imported second-hand buses (10 seats and more) and vans must be less than 7 years old.

Imported second-hand lorries must be less than 10 years old.

Exemptions

Certain special groups are exempt from paying taxes on imported goods. These include returning residents, diplomats, and temporary import permit holders. Consult local clearing agents for additional information.

Required Documents

-

Bill of Lading/Manifest

Ensure you possess the original Bill of Lading. - Vehicle Inspection Certificate from South Africa

- Commercial Invoice

- Passport, Identification Document, or Certificate of Incorporation for Companies

-

Certificate of Title and Registration (Natis - RC1)

Provide the original certificate of title and registration for the imported vehicle. - SARPCCO Certificate and Police Clearance

Procedure: Your South African Vehicle

Effortlessly navigate the process from selection to delivery, ensuring a smooth and secure acquisition of your South African vehicle.

Choose Your Vehicle

Discover your ideal vehicle: Browse new South African models or used cars online. Connect with us to negotiate an excellent deal directly or let us secure the best value options for you.

Invoice and Acceptance

Upon vehicle selection, receive a Proforma Invoice with CIF pricing. Confirm, review, & secure your chosen vehicle by placing a small holding deposit to kickstart the export process.

Payment and Insurance

Finalize payment with the South African dealer, ensuring comprehensive insurance until arrival, excluding ocean freight. Kalali Motors initiates export with dealership documents.

Logistics and Delivery

Book with a carrier, get confirmation, Kalali Motors manages documentation. Local agent receives documents, track shipment, await smooth delivery facilitated by agent.